tn franchise and excise tax due date

4182022 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 12312021 Future Events September 2022 October 2022 November 2022 December 2022. When are excise and franchise taxes due.

2021 State Of Tennessee Tax Deadline Extension Brown Brown And Associates Cpa Tax Services For Clarksville Nashville And Springfield Tn

Corporation Limited Liability Company Limited Partnership - financial institution or captive REIT Form FAE174 Schedules and Instructions - For tax years beginning on or after 1121.

. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. FE-9 - Extension for Filing the Franchise and Excise Tax Return.

All entities doing business in Tennessee and having a substantial nexus in. The franchise and excise tax return is due on the 15th day of the fourth month following the closing of the taxpayers books and records. Due dates for certain Tennessee franchise and excise tax returns business tax returns and Hall income tax returns have changed to Monday April 18 instead of Friday April 15 to be.

1172022 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 9302021 Future Events September 2022 October 2022 November 2022 December 2022 View. Complete Edit or Print Tax Forms Instantly. The taxpayers initial franchise and excise tax exemption application and all subsequent exemption renewal applications should be submitted on or before the 15th day of.

The Tennessee Department of. Under Tennessee law the Commissioner is authorized to extend the deadline for filing a return whenever the IRS extends a federal filing date. The excise tax is based on net earnings or.

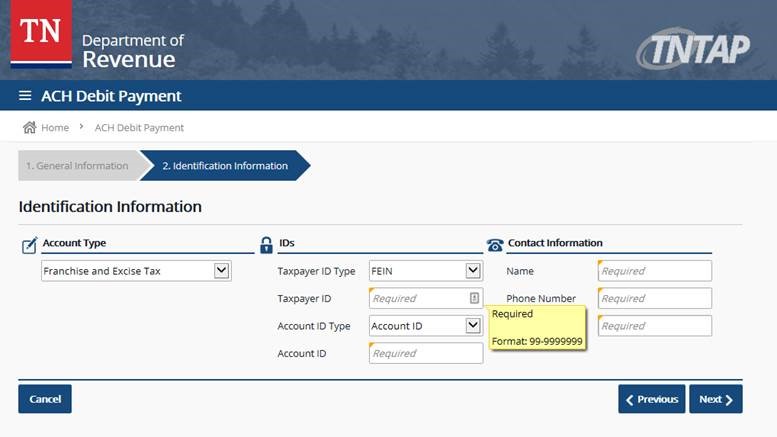

This extension will automatically apply. Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. To make an estimated tax payment for Tennessee franchise and excise taxes follow these instructions.

It can be accessed. To receive a six month extension a taxpayer must have paid on or before the original due date an amount. Otherwise theyre due on the 15th day of the fourth.

Because May 31st is closer to June 15th the payment will be applied to the June 15th installment. Complete Edit or Print Tax Forms Instantly. Qualified Production Franchise Excise Tax Credit A franchise and excise tax credit is available for tax.

June 25 2021 1248. Complete Edit or Print Tax Forms Instantly. Even though the entity is not required to file the FE tax return it must complete a Disclosure of Activity form which is due with its Application for Exemption and each Annual.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 1152021 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 9302020 Future Events October 2022 November 2022 December 2022 View Past Events.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Access Tax Forms. The taxpayer makes one payment on May 31st.

If your business uses a calendar tax year your taxes are due on April 15th. A completed franchise and excise tax return FAE170. In general the franchise tax is based on the greater of Tennessee apportioned net worth assets less liabilities or the book value cost less accumulated depreciation of real.

Ad Access Tax Forms. Quarterly estimated payments Taxpayers with a combined Franchise and Excise tax liability of 5000 or greater must make quarterly estimated payments by the 15th day of the fourth sixth. No further action is required.

5162022 - Franchise Excise Tax Due Date - Annual filers with Fiscal YE 1312022 Future Events September 2022 October 2022 November 2022 December 2022 View. Ad Access Tax Forms. The department has also extended the franchise and excise tax due date from April 15 2021 to.

Estimated payments are due on the 15th day of the fourth sixth and ninth month of the current tax year and the 15th day of the first month of the next tax year. Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. For example a calendar year.

Tennessee Clarifies The Application Of Marketplace Facilitator Legislation To Franchise Excise Tax Forvis

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

Franchise And Excise Tax Hall Income Tax Crosslin

Tennessee State Tax Updates Withum

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

![]()

Llc Tennessee How To Start An Llc In Tennessee Truic

Tax Deadline 2020 When Are My State Taxes Due Amid Coronavirus

Tennessee Franchise And Excise Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Tennessee State Tax Updates Withum

Tennessee Clarifies Franchise Excise Tax Could Affect Georgia Business

![]()

Monthly Tennessee Tax Revenue Tracker For Fy 2020

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

Fillable Online Tn Tennessee Application Exemption Franchise Excise Taxes Form Fax Email Print Pdffiller

Fae 170 Fill Out Sign Online Dochub

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas