tax shield formula dcf

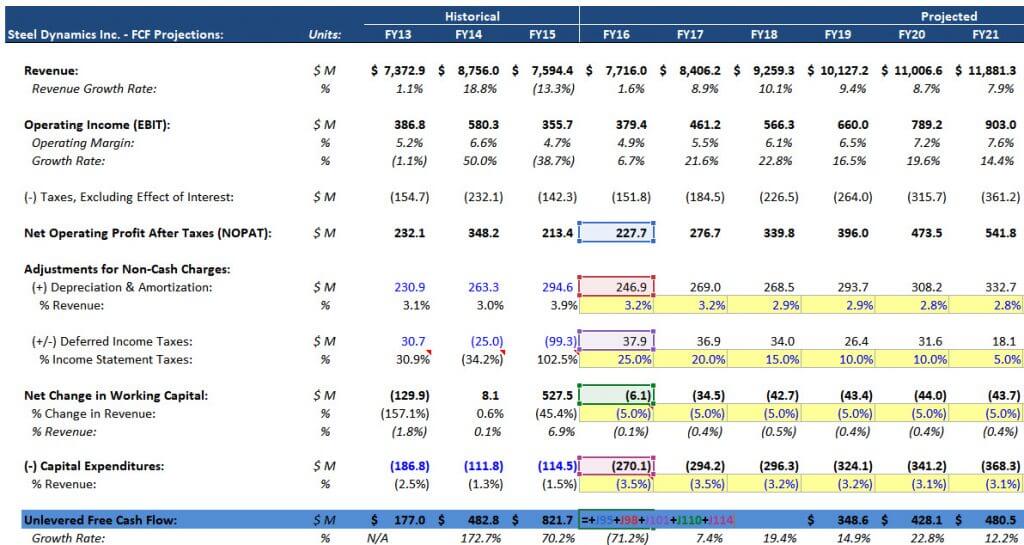

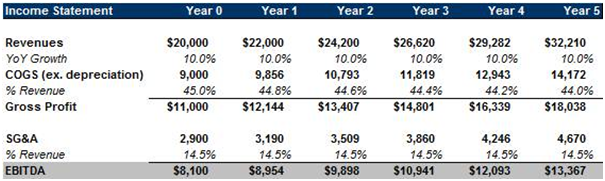

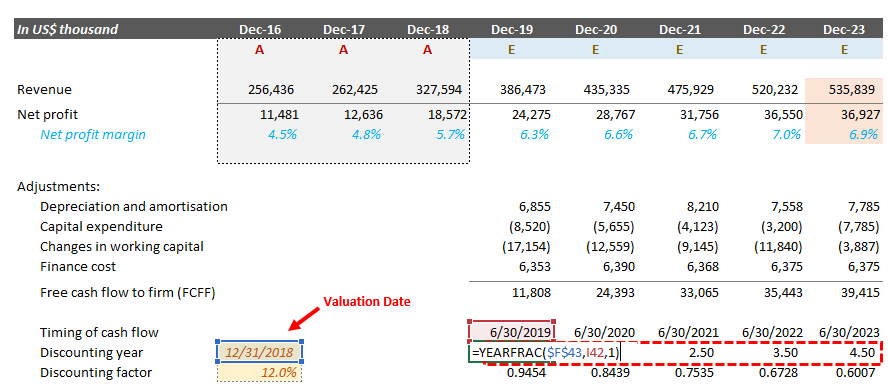

The standard WACC approach. How the DCF Works Overview Based off any available financial data both historical and projected the DCF First projects the Companys expected cash flow each year for a finite.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

. The formula includes that comes from tax shield savings. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Interview questions around the Depreciation Tax Shield are quite common because it ties directly into the Discounted Cash Flow DCF analysis process.

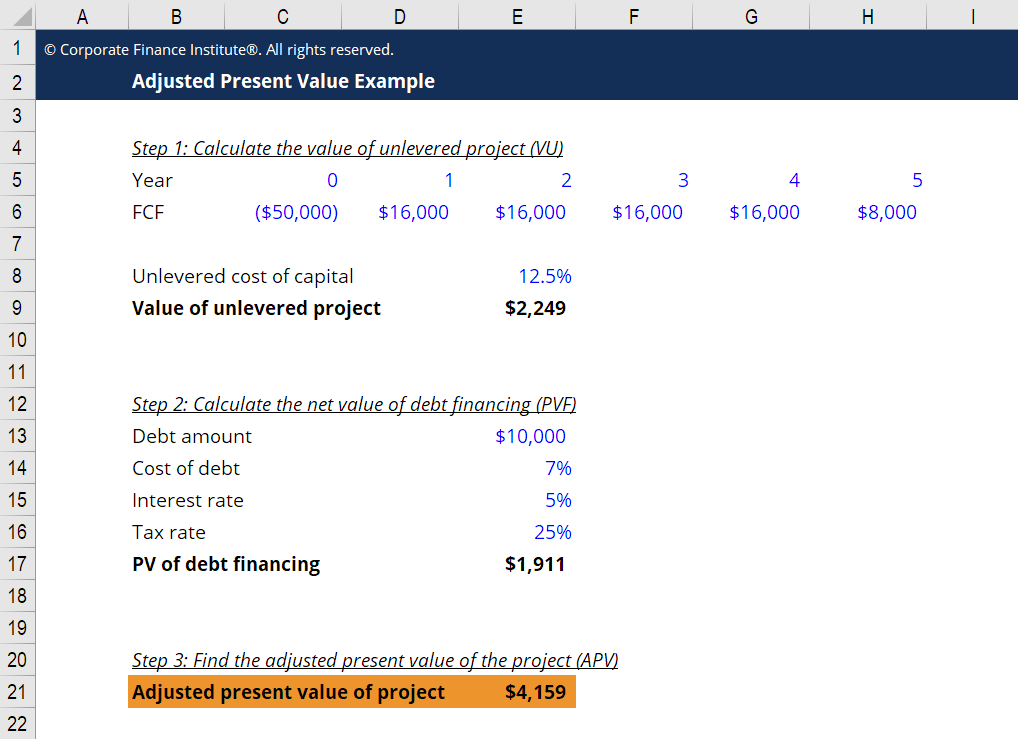

Depreciation Tax Shield Formula. The flows to equity method. The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any.

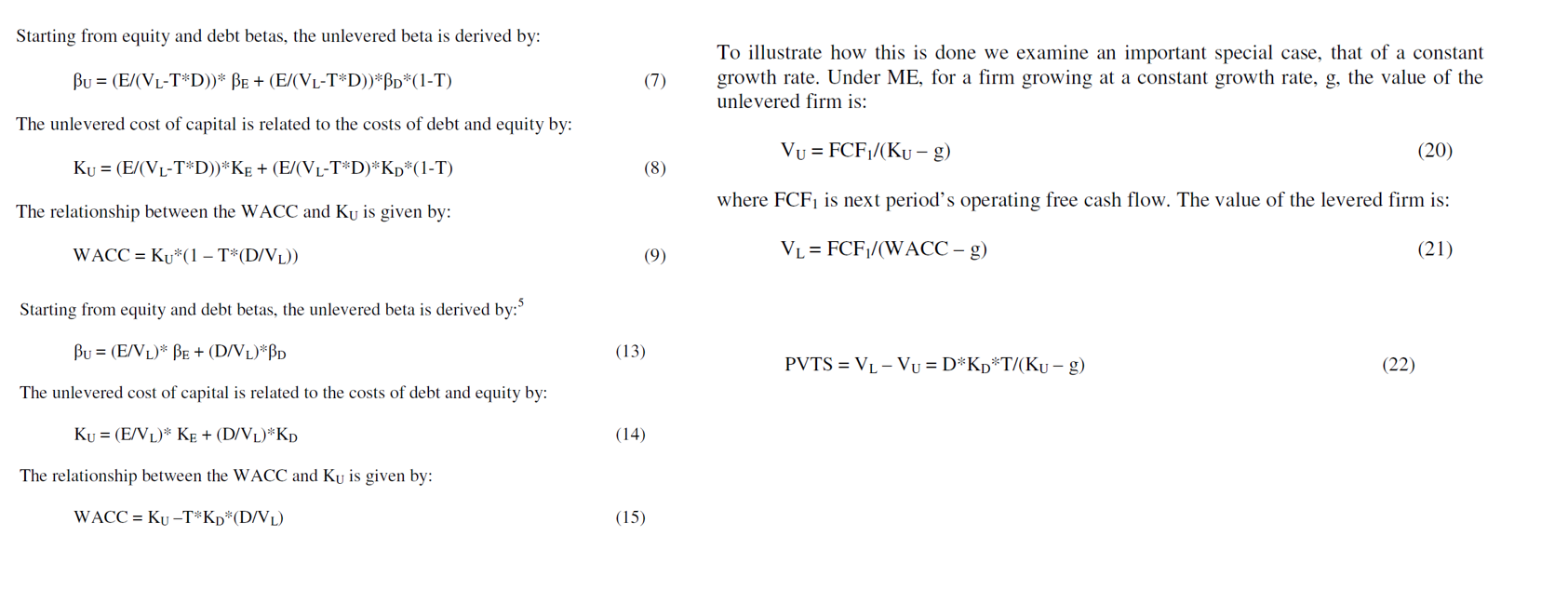

And stand for debt and equity of the firm and are the required return rates for debt and equity is the marginal tax. Here is a step-by-step example of how to calculate unlevered free cash flow free cash flow to the firm. FCFFa EBIT 1-tax rate Non-Cash Charges Depreciation - Working Capital investments - Fixed capital investments Or rewriting in a short way using abbreviations.

Adjusted Present Value - APV. The DCF valuation of the business is simply equal to the sum of the discounted projected Free Cash. Is the levered DCF formula to calculate FCF the following one.

Interest Tax Shield. Concerning DCF there are three widely used methods to calculate the present value of a company. The intent of a tax shield is to defer or eliminate a tax liability.

In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense. Interest Tax Shield Interest Expense Deduction x. A tax shield is the deliberate use of taxable expenses to offset taxable income.

DCF MA LBO Comps and Excel shortcuts. Begin with EBIT Earnings Before Interest and Tax Calculate the. Formula and Excel Calculator.

Levered DCF Formula. FCF EBIT 1-T DA - CAPEX - Change in working capital -.

Example 2 Finding Pvccats For Declining Balance Method Calculate The Annual Cca Course Hero

Npv And Irr Calculation Based On The Fcfe Technique For Example 1 Download Table

Interest Tax Shield Formula And Calculator Step By Step

Tax Principles Part 2 Valuing Nols Multiple Expansion

What Is The Depreciation Tax Shield The Ultimate Guide 2021

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Using Apv A Better Tool For Valuing Operations

Adjusted Present Value Apv Definition Explanation Examples

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Overview Modano

Interest Tax Shield Formula And Calculator Step By Step

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Overview Modano

Using Apv A Better Tool For Valuing Operations

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Tax Shield Definition Example How Does It Works

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Pdf The Present Value Of The Tax Shield Pvts For Fcf In Perpetuity With Growth